Increased water bills and strong Peso seriously impact budgets

Last week, your HOA received two financial reports, both of them showing serious fiscal "challenges." Let’s look at the reports, causes, implications and alternatives for action going forward.

Our Operating Budget. The June financial statements show a $18k expense variance for the month on about a $105k monthly expense budget, causing a $16k bottom line deficit for the month. Higher utilities expenses are $17k over budget for the month, explaining almost all of the overrun. Most of that utility expense variance was explained by the unbudgeted 36% increase in the cost of water.

Our Operating Budget. The June financial statements show a $18k expense variance for the month on about a $105k monthly expense budget, causing a $16k bottom line deficit for the month. Higher utilities expenses are $17k over budget for the month, explaining almost all of the overrun. Most of that utility expense variance was explained by the unbudgeted 36% increase in the cost of water.

On the year-to-date section of that June financial statement, we are $29k over the expense budget for the first 6 months. The expense budget for that 6-month period totals $624k. Utilities expenses again were the main culprit – it was $31k over a budget of $170k, or 18%.

Our First Draft Estimated 2024 Budget (in process). Associa helps the Board forecast a realistic budget by taking a spreadsheet that shows each line-item of expenses and then applying either a general inflation number or specific information about what may happen next year. They also take into account currency exchange rate fluctuations. That process is underway.

The Board did not wait for Associa, but did a simple extrapolation, factoring in a) the 36% price increase for water, b) the currency exchange rate challenges and c) general inflation of 5%. That analysis showed that the 2024 budget would need to increase just over 27% when expressed in dollars.

The strong Mexican Peso, which recently traded at 16.75:1 to the US Dollar, creates most of the problem because about 90% of our expenses are paid in MXN, and our 2023 budget was set when the exchange rate was 20.28 MXN to 1 USD.

Bottom line on Budget: The first draft of the budget will show something like a 27% increase, less any savings (see below). But even that is not the end of the analysis. We need to look closely at the portion of the operating budget which is “contributions to Reserves” and make sure 27% is enough.

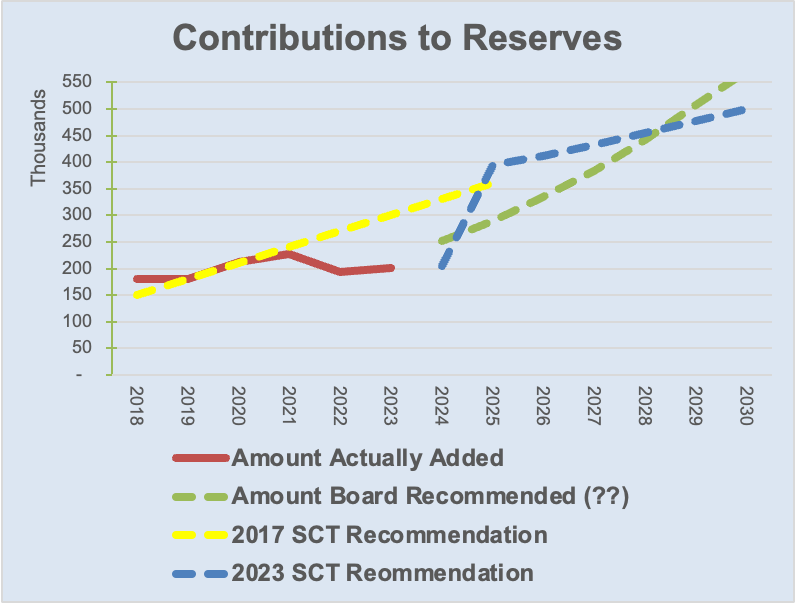

Our Reserves Budget. This is a much longer discussion, but SCT Reserves (the professional services firm that provides Reserves Studies to California condominiums) is recommending that we radically increase the annual contributions to Reserves. We have some quibbles with their initial draft, but, even with our revised numbers, Las Mañanitas is still only 28% "fully funded" for future Reserves. (See this blog post for an explanation of how reserves work.). Here it is graphically:

The Red line is our ACTUAL contributions thru 2023. For 2024-2030, the Green line shows an assumption that we’d use a 25% growth factor for 2024, and 15%/year thereafter. Those numbers for future years are subject to decisions by future Boards and Assemblies.

The Yellow line is what SCT Reserves (our professional Reserves Study provider) recommended we should be contributing to Reserves each year, according to their 2017 report.

The Blue line is what SCT is recommending now. (Here is the first draft of their 2023 report).

The Green line is one possible way we could address the shortfall. Another is to apply a "special assessment" to get caught up more quickly and then reduce the amount of the annual increases.

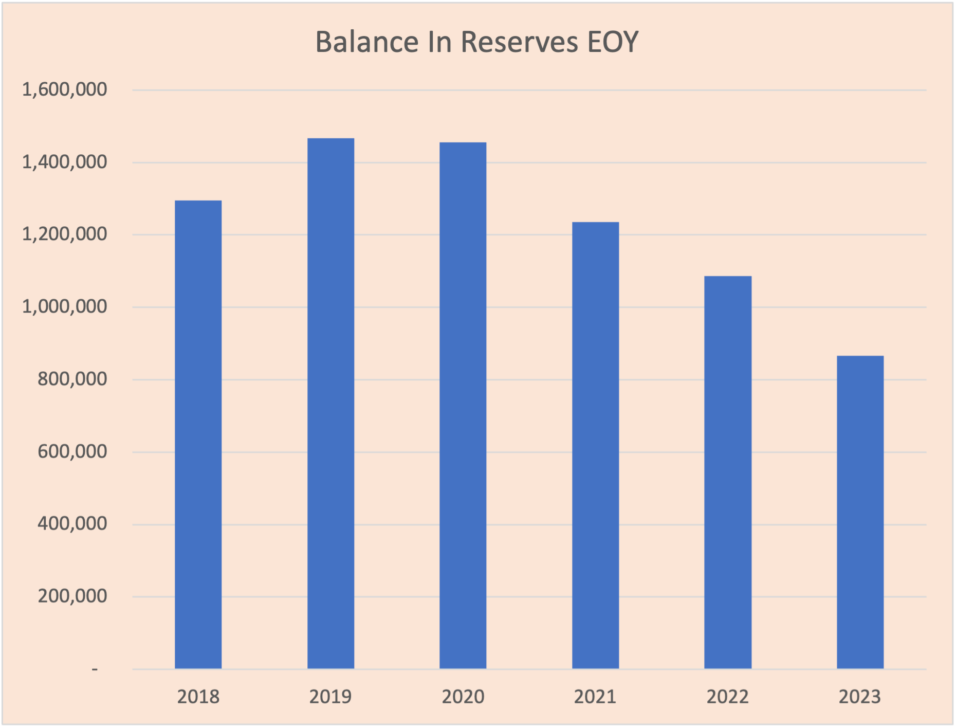

As you can see, in 2020 our HOA diverged from the 2017 SCT recommendations, and, given larger unanticipated repairs occurring in 2021 and 2022 after Covid, you can see the results in end-of-year balances of our Reserves funds:

It’s basic math. If you are under-reserving and making large repairs, your savings will dwindle or you’ll defer maintenance and cause problems later.

Here's another way to look at Reserves: According to SCT, we should have $3.1 million in Reserves to be "fully funded" per their definition and assumptions. The Board believes that building reserves to have $2.0 million on hand would probably be an adequate number … giving us a little buffer for post-Hurricane spending while we await insurance settlements. We will end 2023 at about $800k.

Some History: The Assembly approved using just over $1 million USD from Reserves during the 2017-2021 period to purchase properties from the Developer, namely, the pool bars, restroom areas, gym, tennis court, front office, office building and unsold garages. Had we not done that, reserve levels would likely now be about $2 million. Also, during the first ten years of Las Mañanitas (2001-2011), when the Developer served as Administrator, it did not build Reserves. In 2011, the Developer turned over the property to the HOA with very little money in the Reserve accounts, along with significant "deferred maintenance" needs. Starting in 2011 the HOA performed many repairs while also building Reserves. Sadly, those repairs were then destroyed by Hurricane Odile! [Note: Hurricanes or earthquakes can significantly deplete Reserves overnight! That's another reason to have them.]

Anyway, after finishing the projects scheduled for this year, our Reserve balance will be about $800k. Because the buildings are passing their 20th anniversary, some important maintenance is coming due, too. Increasing the rate of contributions to Reserves is necessary.

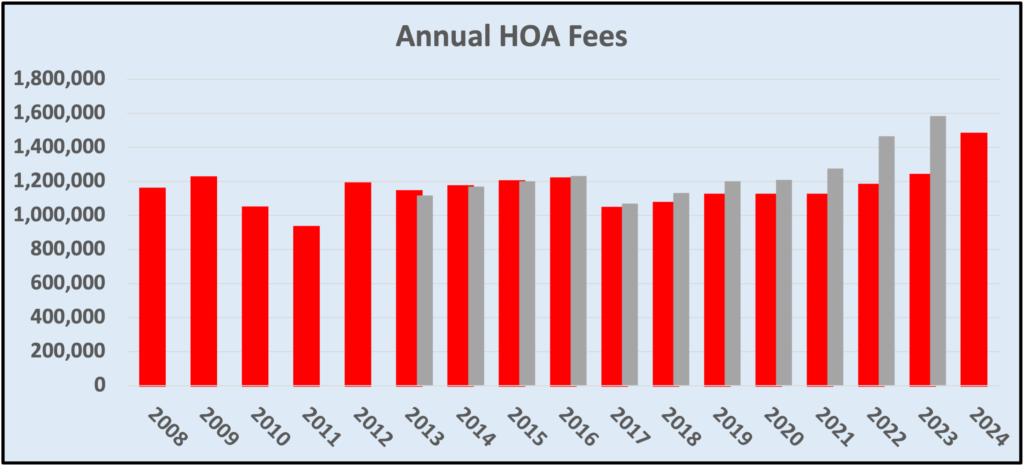

Last, I make note that our HOA Dues are falling significantly behind inflation. Compare our dues (red bars) with general inflation (grey bars)

The Red bars are our actual HOA fees (and assuming an increase in 2024). The Grey bars are what they would have been if we simply kept pace with inflation since 2013.

What Can We Do About It

Here are the logical possibilities to limit budget increase to < 27%

- Change our “functional currency” to MXN. That avoids the currency issue by offloading the MXN:USD exchange risk on Owners. After debating the pros and cons, the Board felt this was not efficient and really didn't change the cost to Owners.

- Go line-by-line and change specs – e.g. don’t heat pools, change security staffing or cleaning schedules, scrutinize overhead; self-insure. With the exception of water expense and Reserves Spending, we decided not to try to change any of the "high-end" specifications that make Las Mañanitas a safe, beautiful, comfortable community.

- With regards to water, the Community Manager, the landscape contractor, and the Landscape committee will review the irrigation systems and schedules to ensure optimal use of water for irrigation. By the way, about 10% of our water use during the summer goes to refill pools that lose water to evaporation.

- With regards to Reserves Spending, we'll try to recruit Owners who are experienced in construction and facilities to review the timing of some of the maintenance and repairs.

- The Community Managers will be given goals to save money in other line items. In the last two years, they have done well. Last year, there was a $39k surplus, and this year's deficit will be much less than what would be the case if they simply spent the MXN-based expenses from last year.

- Rely on Special Assessments

- We use "special assessments" every 5 or 6 years to add to Garage Reserves, and we are due again.

- We might consider doing a "special assessment" to help establish larger Reserves balances (and then perhaps reduce the annual contribution to reserves?)

- Defer maintenance and projects - see item 2 above.

- Sell some of the HOA garages ($50k each) - This might help a little but is not a long-term fix.

The final budget recommendation for 2024 will be decided at the August 25th Board meeting. The final decision will be voted on by the Owners at the Assembly on November 4th.