“Reserves Study” To Assess Adequacy of Our Reserves

I'm not going to repeat the key terms defined in Everything You Wanted To Know About Reserves. Please at least skim the section entitled Are our Reserves Adequate before reading more here.

Seriously. I'll wait.

OK, what are we trying to accomplish? Let's start with the goals and KPIs:

- The mission of Las Mañanitas HOA is to secure a safe, sound, beautiful, comfortable community.

- Sound is defined as A) capital reserves > what's required, and B) our annual HOA fees < the fees in "peer properties."

- Our overall measure of success is resale prices higher than those of peer properties. How do Reserves influence that measure? Well, if buyers have confidence that they won't face a big, unplanned "special assessment" after buying, they might pay more for your Unit.

Las Mañanitas has about just over $1 million in reserves for all Phases. Is that enough? Well, if we have a lot of "deferred maintenance," then it probably isn't enough. If maintenance is relatively current and we don't have many major projects, then it may be enough. So ... it depends. How can we know?

It turns out that professional "Reserve Study" firms have been developed to help California condominiums meet the state law that requires outside studies to be conducted and circulated among Owners. (The law is meant to protect buyers who get socked with big surprises after buying into a project that has neglected its buildings and common areas. Ontario has a similar law.)

These reserve study firms have a straightforward way to conduct an analysis:

- List each and every "Major Component" -- which is defined as "something that needs to be repaired or replaced within 30 years of installation." The concrete walls of our buildings are NOT Major Components (because they last > 30 years). But the paint on the walls IS a Major Component because it needs to be refreshed every 7 years or so.

- Then, list for every Major Component:

- What that component costs if bought today. Example: Painting the buildings for all three Phases and the garages might cost $450,000. [Note: I have no idea. It might be more or less.]

- How long that component normally lasts? (That is, what is the economic life?) Let's say the paint on the residential buildings lasts 7 years, and paint on the garages lasts 8 years.

- How many years are left until you need to replace it? (How close is "end of life?"). Let's say the buildings need paint now. So we could assign 0 or 1 years of life left for these variables.

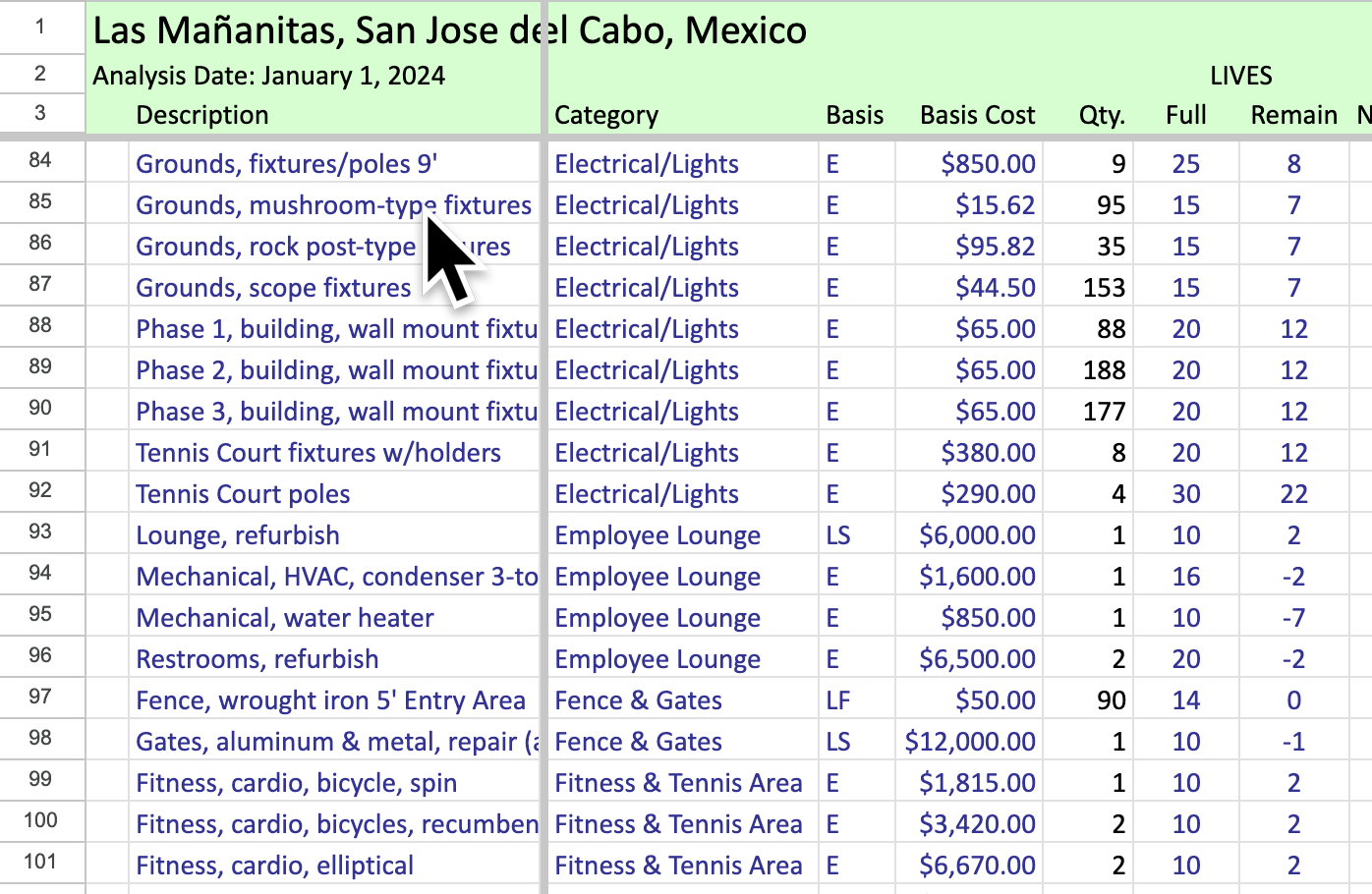

- Note: Each line item is unique. Here is the sample from the study done in 2017, pasted into a new spreadsheet we are updating for a new study:

Once all that information is complete and accurate, then the Reserves Study professionals just "run the numbers." They assume when the "remaining life" decrements to zero, the HOA WILL spend the money to replace/refresh the item. They forecast the effects of inflation.

Once they finish forecasting all the expenses coming over the next thirty years, they can calculate how much we need to set aside every year to ensure that the HOA will have the money when we need it. (That's what is meant by the line item "Contribution to Reserves" on the last page of our annual budget.)

What Did Prior Boards Do?

The HOA conducted a Reserves Study in 2013 shortly after they came into being. That Study concluded that Reserves were only 40% of "fully funded." So, the Owners increased contributions to reserves during the 'teens.

Very few condominium communities insist on getting to 100% of "fully funded" for reasons we can discuss. As Kuester, a regional real estate management company said in a recent blog post:

Ideally, your community wants to have a 100 percent funded HOA reserve account, meaning that it has enough money to cover all anticipated costs. In lieu of a fully-funded reserve, even 70 percent is pretty decent. Anything below 70 percent, however, and the HOA faces the likelihood of needing to leverage special assessments or increase association dues in order to cover costs. This can be unwelcome among the members who must come up with this money without any advance warning.

In 2017, the HOA Board paid for an update to the 2013 Reserves Study. That Study found that the Reserves had grown to 53% of "fully funded," and the Reserves Study professionals recommended that we ramp up our annual contributions by about 10% per year ... which we have not done.

So now, this year, we are doing another study -- this one a comprehensive "Level 1" study ... from the ground up, with on-site inspections. The report will be made available to the Vigilance Committees in July and the November Assembly when done. As a community, we'll get a clearer picture of what our reserves ARE and what we need to do in the future.